UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant☒ |

Filed by a Party other than the Registrant☐ |

Check the appropriate box: |

☐ | Preliminary Proxy Statement | |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) | |

☒ | Definitive Proxy Statement | |

☐ | Definitive Additional Materials | |

☐ | Soliciting Material under§240.14a-12 |

| AMERICAN HOMES 4 RENT | ||||

| (Name of Registrant as Specified In Its Charter) | ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check | ||||

| ☒ | No fee required. | |||

| ||||

| ||||

| ||||

| ||||

| ||||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | ||||

| ||||

| ||||

| ||||

| ||||

TO THE SHAREHOLDERS OF

A Message from Our Chairman

AMERICAN HOMES 4 RENT

April 1, 2020

Dear American Homes 4 Rent Shareholder:shareholders:

As we embark on the second decade of our business, I want to thank you for your support and confidence in our ongoing mission to simplify the way America lives. We have accomplished tremendous success in the last ten years. Together, we transformed the real estate sector by developing an innovative product: the professionally-managed single-family rental home.

Our original purpose was to provide a high-quality, accessible housing option with superior service. Our work in the early days rehabilitated communities and stabilized the housing market after The Great Recession. Today, our industry is 30% larger than when we began. We operate in 22 states and more than 30 markets, delivering an exceptional leasing experience to 200,000+ residents across the country.

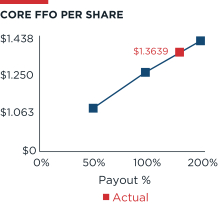

In 2021 alone, we experienced a year of outsized growth, punctuated by: ending the year with 3,000 more homes than we started with, totaling 57,024 homes; revenues in excess of $1.3 billion; and an increase in core funds from operations per share of 17% over the prior year. But our most meaningful accomplishment has been cementing a robust foundationfor the future. Bolstered by our strong balance sheet, our diversified portfolio, our relentless focus on resident satisfaction and our values-driven culture, we look forward to building on this foundation into another decade.

In order to continue making a positive impact on our residents, our employees and you, our investors, we ask for your voting support on the proposals detailed in this proxy statement. We encourage you to review each proposal closely before voting.

In light of continued health concerns relating to COVID-19, we are once again hosting our Annual Meeting of Shareholders virtually. On behalf of the Board of Trustees, (the “Board”) of American Homes 4 Rent, I am pleased to invite you to our 2020 Annual Meeting of Shareholders (the “Annual Meeting”). The meeting will be heldjoin us on Thursday,Tuesday, May 7, 2020,3, 2022, at 9:00 a.m., local time, at our office located at 30601 Agoura Road, Suite 200, Agoura Hills, California 91301. You may attend the meeting in personPacific Time, virtually or by proxy. While we intendYou will be able to hold the Annual Meeting in person, we are actively monitoring the coronavirus (COVID-19) situation. We are sensitive to the public healthparticipate, vote your shares electronically and travel concerns our shareholders may have and the protocols that federal, state and local governments may impose. In the event it is not possible or advisable to hold the Annual Meeting in person, we will announce the alternative meeting arrangements, which may include changing the date or location of the meeting or holdingsubmit your questions during the meeting by means of remote communication (i.e., virtual meeting), in a press release filed with the Securities and Exchange Commission as promptly as practicable. You are encouraged to monitor our website at www.americanhomes4rent.com under the tab “For Investors” for updated information about the Annual Meeting. The matters to be considered at the meeting are described in detail in the attached notice of meeting and proxy statement. You are encouraged to review them before voting.

During 2019, we continued to drive increases in shareholder value at American Homes 4 Rent and delivered an approximately 36% total return to our shareholders, including reinvested dividends. We are focused on improving operational efficiencies and growing our business to continue to grow long-term shareholder value with our geographically diversified,best-in-classvisiting: www.virtualshareholdermeeting.com/AMH2022. portfolio. Ourone-of-a-kind development program continues to pay dividends, offering us homes customized with the features our research shows prospective residents want and value. We also believe our investment grade balance sheet is a significant differentiator that will help shelter our investors from market turbulence.

Your Board has been instrumental in overseeing our strategy. Since January 2019, the Board expanded its perspective and experience with the addition of three new, highly qualified, independent trustees. Collectively, our Board members hold a significant investment in the company, demonstrating their strong belief in the company and their alignment with our shareholders.

Your vote is important and we urge you to cast your voteit as soon as possible. You may vote your shares over the Internet,online, by telephone or byvia mail by following the instructions on the proxy card or voting instruction form by signing, dating and returning the enclosed proxy card. If you attend the meeting,virtual Annual Meeting, you may revoke your proxy at the meeting and vote your shares virtually.

If you have any questions, please contact D.F. King & Co., Inc., our proxy solicitor assisting us in person fromconnection with the floor.2022 Annual Meeting. Shareholders in the U.S. and Canada may call toll-free at (877) 283-0321. Banks and brokers may call collect at (212) 269-5550.

We appreciate your continued trust and confidence as an investor in American Homes 4 Rent.Sincerely,

Kenneth M. Woolley Chairman of the Board March 18, 2022 |

|

|

AMERICAN HOMES 4 RENT

30601 Agoura Road, Suite 200

Agoura Hills, California 91301A Message from Our CEO

Dear American Homes 4 Rent shareholders:

At our core, we work to provide American households access to the joys of single-family living. Since 2011, we have delivered this through high-quality homes with the added support of our professional leasing, property management and maintenance services. We simplify a basic need in our residents’ lives, so that they can focus on what is truly important to them—so that they can sleep easier at night and spend more time with their families on weekends. Taking care of people has always been at the heart of our business. And we take this responsibility seriously.

NOTICEOFTHE 2020 ANNUAL MEETINGOF SHAREHOLDERSToday, we continue investing in creating a resilient, sustainable and inclusive organization to earn the trust of those who rely on us—and deliver lasting value to you, our shareholders, as well as our residents and employees. This year, we were honored to be named one of America’s Most Responsible Companies by Newsweek and Statista, a Great Place to Work® and a Top ESG Performer in our sector by Sustainalytics. As we build the future of America, we remain firmly committed to leading the housing industry with integrity and operating mindfully in our workplaces, our residences and our communities.

Since last year’s report, we launched an Employee Stock Purchase Program, a Tuition Reimbursement Program, Employee Resource Groups and a Workday Peakon Employee Voice survey platform to strengthen the dedicated team that fulfills our mission. We also piloted a renewable energy program at select amenity centers, conducted a materiality assessment to identify the most critical sustainability issues for our organization and started implementing an Environmental Management System to better manage our ecological footprint. Additionally, we formalized a Sustainability function to hold us accountable to the corporate governance standards that pillar responsible business, consistent with our founding principles. We have always taken the long view, inspired by the visionaries that established our company, and our second chapter will read no differently.

As we turn the page on a new decade, we remain sharply focused on providing quality and simplicity through our products and services, meeting the evolving demands and realities of the current generation and contributing long-term solutions to a challenging housing landscape. According to the U.S. Census, our country is short five million housing units. Put simply, America needs more and better housing. Through our development pipeline, we are delivering Class-A residences that are adding critical supply, upgrading the rental stock, stabilizing local neighborhoods and economies and offering a viable option for working families in an underserved market. On the heels of our debut as a top national homebuilder on the Builder100 List this summer, we launched our 100th new community. And we are only at the dawn of our growth in this sector.

After ten years of success and innovation in redefining the concept of single-family living, we are positioned now for an even bolder future as an established real estate leader. Our purpose today, and beyond, is to empower the millions of households already choosing to rent single-family homes in the U.S. with a better option—an option that is not just mortgage-free but stress-free, and accommodates an unburdened lifestyle of flexibility and mobility in the era of remote work. We are looking forward to the next chapter in our journey to walk America home, and we are grateful that you march with us.

Sincerely,

David P. Singelyn

Chief Executive Officer and Trustee

March 18, 2022

The 2020

Notice of the 2022 Annual Meeting of Shareholders (the “Annual Meeting”) of American Homes 4 Rent, a Maryland real estate investment trust, will be held at the time and place and for the purposes indicated below.

| Date and | Tuesday, May |  | Virtual Location Visit: | ||||||||||||

Items of Business

| ||||

| To elect as trustees the | ||||

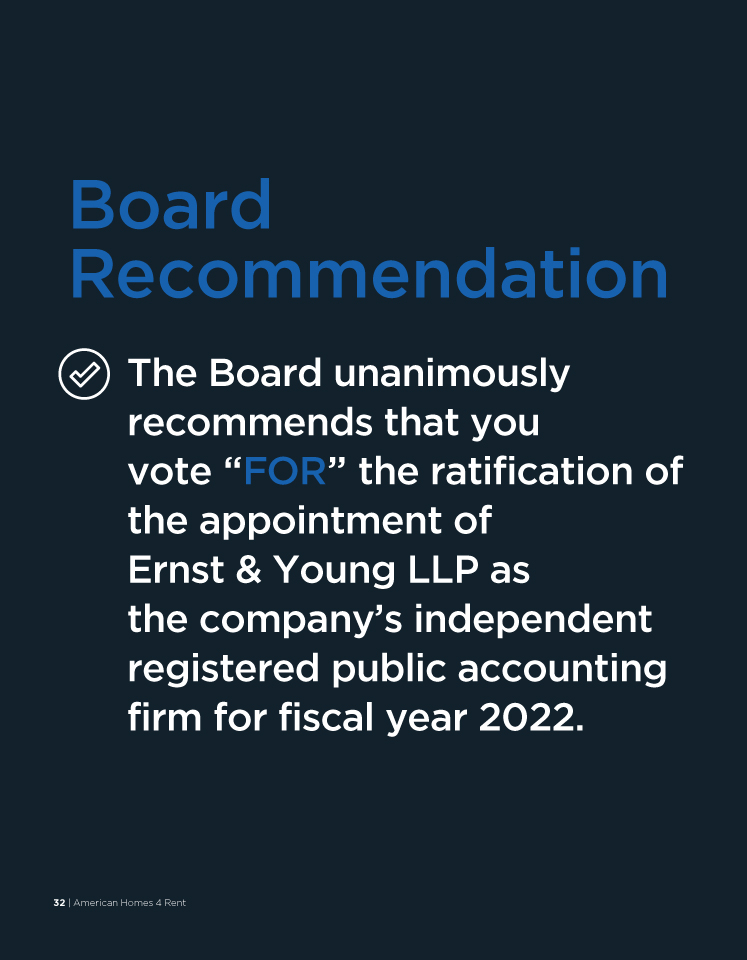

2 | To ratify the Audit Committee’s appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, | |||

| 3 | To hold anon-binding, advisory vote to approve our named executive officer compensation; and | |||

4 | To consider and act upon any other matters as may properly come before the | |||

Recommendations of the Board

The Board of Trustees unanimously recommends that you vote “FOR” each of the trustee nominees named in the attached proxy statement, “FOR” ratification of the appointment of Ernst & Young LLP and “FOR” approval, on an advisory basis, of our named executive officer compensation. Detailed information concerning these proposals is included in the accompanying proxy statement.

Proxy Materials

The notice of meeting, proxy statement and Annual Report on Form 10-K are available free of charge at: www.americanhomes4rent.com/Investors/AnnualMeetingDocs2022. The proxy statement and accompanying proxy card are being sent or made available to you on or about March 18, 2022.

Record Date

You are entitled to vote at the meeting if you were a shareholder of record at the close of business on March 7, 2022 of our Class A or Class B common shares of beneficial interest, par value $0.01 per share.

Voting

Your vote is very important. To ensure that your shares are represented at the Annual Meeting, please vote over the Internet, by telephone or by mail as instructed on the proxy card or voting instruction form you receive. You may revoke a proxy at any time prior to its exercise at the meeting by following the instructions in the accompanying proxy statement.

2022 Proxy Statement

By Order of the Board of Trustees,

Sara H. Vogt-Lowell

Chief Legal Officer and Secretary

March 18, 2022

If you have questions about the matters described in this proxy statement, how to submit your proxy or if you need additional copies of this proxy statement, you should contact D.F. King & Co., Inc., our proxy solicitor, toll free at (877) 283-0321 (banks and brokers may call collect at (212) 269-5550).

Important Notice Regarding Availability of Proxy Materials for the 2022 Annual Meeting on May 3, 2022: This Proxy Statement and our 2021 Annual Report on Form 10-K are available on the company’s website www.americanhomes4rent.com under “Investor Relations.”

American Homes 4 Rent

| ||||

2 | ||||

3 | ||||

4 | ||||

5 | ||||

6 | ||||

6 | ||||

6 | ||||

6 | ||||

7 | ||||

8 | ||||

8 | ||||

8 | ||||

8 | ||||

8 | ||||

9 | ||||

11 | ||||

12 | ||||

19 | ||||

19 | ||||

23 | ||||

25 | ||||

29 | ||||

30 | ||||

31 | ||||

33 | ||||

34 | ||||

35 | ||||

35 | ||||

36 | ||||

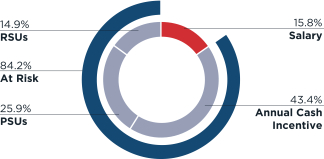

Executive Officer Share Ownership and Other Compensation Policies | 37 | |||

37 | ||||

37 | ||||

37 | ||||

39 | ||||

39 | ||||

2022 Proxy Statement

40 | ||||

40 | ||||

40 | ||||

40 | ||||

41 | ||||

42 | ||||

43 | ||||

44 | ||||

46 | ||||

Role of Management and Board in Determining the Compensation of Executive Officers | 47 | |||

47 | ||||

47 | ||||

48 | ||||

49 | ||||

49 | ||||

49 | ||||

49 | ||||

49 | ||||

50 | ||||

51 | ||||

52 | ||||

53 | ||||

53 | ||||

53 | ||||

53 | ||||

53 | ||||

54 | ||||

54 | ||||

55 | ||||

56 | ||||

59 | ||||

59 | ||||

59 | ||||

60 | ||||

American Homes 4 Rent

In 2021, we were named the top 45th homebuilder in the U.S. by Builder100. |

| |||||||

While we intend* See pages 31 to hold the33 and 40 of our Annual Meeting in person, weReport on Form 10-K for a detailed discussion of our financial results for 2021, as well as information regarding Core FFO and Core NOI, which are actively monitoring the coronavirus (COVID-19) situation. We are sensitive to the public health and travel concerns our shareholders may have and the protocols that federal, state and local governments may impose. In the event it is not possible or advisable to hold to hold the Annual Meeting in person, we will announce the alternative meeting arrangements, which may include changing the date or location of the meeting or holding the meeting by means of remote communication (i.e., virtual meeting), in a press release filed with the Securities and Exchange Commission as promptly as practicable. You are encouraged to monitor our website at www.americanhomes4rent.com under the tab “For Investors” for updated information about the Annual Meeting.

By Order of the Board of Trustees,non-GAAP performance measures.

Stephanie Heim

Chief Governance Officer & Assistant Secretary

April 1, 2020Amid a national housing shortage, our homebuilding arm provides a long-term solution designed with both people and the planet in mind. With the delivery of our 100th new development in 2021, we continue to build the future of America responsibly, prioritizing durability and efficiency. This year, we also worked to analyze our environmental impact in order to establish a strategy to manage our carbon footprint.

HERS energy efficiency ratings:

We utilize certified third-party raters and the Home Energy Rating System (“HERS”) to track the energy efficiency of all our newly built homes. For 2021, the average HERS index for our newly constructed homes was 62.8, which means they use nearly 40% less energy than a home built to the 2006 “reference home” standard and less than half the energy of a typical home in this country.

Environmentally-friendly construction:

We use long-lasting flooring, energy-efficient LED lighting, low-flow water fixtures and other eco-conscious features designed to last for decades, both in our newly constructed homes and as we renovate our legacy homes.

Renewable energy program:

As we seek ways to lower our carbon footprint, we piloted a renewable energy program through the installation of solar panels on two amenity centers, which we are closely monitoring as we evaluate its potential expansion to our residences and amenity center portfolio.

Environmental Management System (“EMS”):

In 2021, we began implementing a new EMS for our AMH Development homebuilding operations to rigorously identify, monitor and reduce our environmental risks and impacts.

2022 Proxy Statement | 3

We believe in fostering strong communities for a sustainable society. And we know that this work always starts from within. We are cultivating a people-first culture where we take care of each other, so that together we can take care of the people who make our houses their homes.

|

| Workplace safety: We prioritize the health and well-being of our team. Thanks to our annual safety trainings and rigorous protocols, our OSHA Recordable Incident Rate is at 2.58, which is below the rate of 2.9 for the Lessors of Residential Buildings and Dwellings sector, according to the latest available Bureau of Labor Statistics data for 2020. |

| Training and development: We launched a Tuition Reimbursement Program in support of our team’s personal and professional growth, and to encourage their ability to access lifelong learning opportunities. This expands on our established business and technical skills development program, through which we provide approximately 66,000 hours of formal training, or an average of 43 hours per employee, annually. This is in addition to deskside training and job shadowing hours, both important to our skills training plan. |

| ||||

| ||||

| ||||

2021 training highlights | 66K hours of training provided | 43 average hours of training | ||

4 | American Homes 4 Rent

We remain inspired by our founders, who have always led with integrity. Today, our growth continues to be guided by the same true north: to earn the trust of those who rely on us by doing the right thing. We apply high ethical standards to our operations and processes, so that our decisions result in long-term value for all our stakeholders. | ||||||||

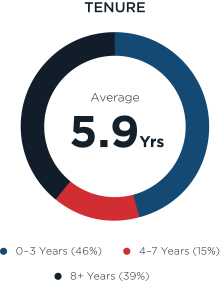

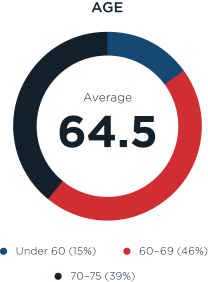

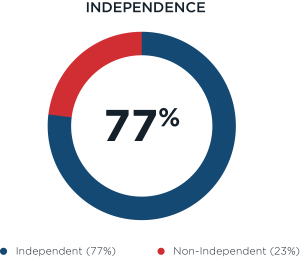

3 new trustees added in 2020 5.9YRS average tenure of trustees 77% of trustees are independent | ||||||||

| Good governance: We observe good governance practices, including an independent chairperson, board diversity by race and gender, annual trustee elections, majority voting, majority voting standard for bylaw amendments and mergers and acquisitions, special meeting rights and no poison pill, clawback or anti-hedging provisions. We also opted out of certain Maryland provisions that can limit shareholder rights.

| |||||||

| Board refreshment: We are committed to regular board refreshment. Since the beginning of 2020, we have added three new trustees, including one female trustee and one Black trustee. All three qualify as independent and bring extensive operational and executive experience to the Board of Trustees (the “Board”). The average tenure of our trustees is 5.9 years, and we enforce a mandatory retirement age of 75.

| |||||||

| Board oversight of ESG: In 2020, we formalized Board oversight for ESG as part of committee responsibilities, which we put into practice throughout 2021. The Nominating and Corporate Governance Committee has overall responsibility for our ESG program with specific topics overseen by the other Board committees. The Human Capital and Compensation Committee oversees our programs on talent, leadership and culture, which include diversity, equity and inclusion. The Audit Committee oversees the company’s policies and procedures with respect to cybersecurity risk management.

| |||||||

| ||||

| ||||

| ||||

| ||||

| ||||

2022 Proxy Statement | 5

ANNUAL MEETING OF SHAREHOLDERS

May 7, 2020Annual Meeting Information

This proxy statement contains important information regarding the 20202022 Annual Meeting of Shareholders (the “Annual Meeting”). Specifically, it identifies the proposals on which you are being asked to vote, provides information that you may find useful in determining how to vote, and describes voting procedures. This proxy statement is being sent or made available to you on or about April 1, 2020.March 18, 2022.

The Notice of Meeting, Proxy Statement and Annual Report on Form10-K are available free of charge at:www.ah4r.com/ForInvestors/AnnualMeetingDocs2020

www.americanhomes4rent.com/Investors/AnnualMeetingDocs2022.

Date and Time: Tuesday, May 3, 2022, at 9:00 a.m., Pacific Time. Virtual Location: www.virtualshareholdermeeting.com/AMH2022. To be admitted, you must enter the control number found on your proxy card or voting instruction form. Record Date: You are entitled to vote at the Annual Meeting if you were a shareholder of record at the close of business on March 7, 2022 (the “Record Date”) of our Class A or Class B common shares of beneficial interest, par value $0.01 per share. Voting: Your vote is very important. To ensure your representation at the meeting, please vote over the Internet, by telephone or by mail as instructed on the proxy card or voting instruction form you receive. You may revoke a proxy at any time prior to its exercise at the Annual Meeting by following the instructions in the accompanying proxy statement.

|

| |||||

|

VIRTUALLY VIRTUALLY |  INTERNET INTERNET |  MAIL MAIL |  TELEPHONE TELEPHONE | |||||||||||||||

holdermeeting.com/ AMH2022 | www.proxyvote.com |

the postage-paid envelope provided | 1-800-690-6903 | |||||||||||||||

|

|

|

|

| ||||||||||||||

| You may vote your shares | You may vote your shares through the Internet by signing on to the website identified on the proxy card or voting instruction form and following the procedures described on the website. Internet voting is available 24 hours a day until 11:59 p.m. | If you choose to vote by mail, simply complete the accompanying proxy card or voting instruction form, date and sign it, and return it in thepre-addressed postage-paid envelope provided. | You may vote your shares by telephone by following the voting instructions on the enclosed proxy card or voting instruction form, respectively. Telephone voting is available 24 hours a day until 11:59 p.m. | |||||||||||||||

6 | American Homes 4 Rent

As summarized below, there are distinctions between shares held of record and those owned beneficially:

|

|

If you require assistance in changing, revoking or voting your proxy, please contact the company’s proxy solicitor:

D.F. King & Co., Inc.

48 Wall Street, 22nd Floor

New York, New York 10005

Banks and Brokers Call Collect: (212) 269-5550

All Others Call Toll-Free: (877) 283-0321

Email: AMH@dfking.com

Unanimous Recommendations of the Board

| Election of the |

| RECOMMENDATION |

| FOR | |||||

| Ratification of the |

| RECOMMENDATION |

| FOR | |||||

| Advisory |

| RECOMMENDATION |

| FOR | |||||

These proposals are discussed in more detail in this proxy statement and you should read the entire proxy statement carefully before voting.We will also consider any other matters properly brought before the Annual Meeting or any adjournment or postponement of the Annual Meeting.

In 2019, we delivered continued growth and solid and sustainable operating performance while continuing to maintain an investment grade balance sheet.

|  |  |  |  | ||||

|

|

|

|

|

|

During 2019, we continued to recognize the importance of integrating sustainability practices into our business objectives. We believe our commitment to sound environmental, social responsibility and corporate governance (“ESG”) practices provides both a superior experience for our residents and employees and attractive returns for our shareholders. For 2020, all members of our senior management have bonus targets that require the achievement of ESG and community service goals. This focus on Profits, People and the Planet reflects our dedication to our shareholders, residents, employees and the environment.

We have ongoing initiatives to reduce our carbon footprint and manage waste in both our operations and development activities. During 2019, we continued to take action to reduce our carbon footprint and manage waste, including efforts to:

Install energy efficient Energy Star appliances, LED lighting andlow-flow water fixtures in our newly constructed homes and as part of our renovations of existing homes;

Install granite countertops and hard surface flooring designed to last for years;

Reduce leasing agent car travel and greenhouse gas emissions with our innovative “Let Yourself In” program that enables tenants to access our homes without a leasing agent;

Reduce water consumption by installing fixtures with automatic shut off features;

Eliminate 2.5 million sheets of paper through our paperless processes for resident applications;

Recycle 160 laptops and copiers through the Blind Center of Nevada;

Include tree planting design as part of our community design;

Educate residents about energy-efficient practices through our resident newsletter; and

Reduce greenhouse gases and drive times for our repair technicians by utilizing software to facilitate accurate diagnoses of repair needs remotely.

Our greatest asset is our employees. We support our employees by seeking to provide a great place to work in a diverse and inclusive environment. We invest in our employees through training and professional development.

We believe a healthy employee is an effective employee. We promote healthy habits and encourage our employees’ physical and emotional well-being through various programs. Those programs include Health and Wellness Fairs, gym membership discounts and corporate challenges. We also implement policies that address occupational health and safety concerns.

Employees are encouraged to give back to their communities by participating in charitable events. Our Planting Seeds program gives employees incentives to volunteer at corporate-sponsored charitable events.

Additional highlights include:

An average of 30 hours of training per year for employees,

More than 400 available online learning and development courses at no cost to our employees, and

More than 100 employees participated in community events in 2019.

We maintain strong corporate governance practices that include transparency, communication and integrity. We describe our corporate governance practices in more detail beginning on page 18. Highlights include:

| ||

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| ||||||||

2022 Proxy Statement | 7 | ||

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

PROPOSAL 1The Annual Meeting will be held in virtual-only format in light of the ongoing COVID-19 pandemic. You will be able to attend and participate in the virtual Annual Meeting, vote your shares electronically and submit your questions during the meeting by visiting: www.virtualshareholdermeeting.com/AMH2022.

ELECTION OF TRUSTEESWe believe this virtual format will enhance shareholder participation, as shareholders will be able to attend the Annual Meeting and engage in the live, online question and answer (“Q&A”) session from any convenient location. Conducting the meeting virtually will ensure shareholder access to management despite the ongoing uncertainty related to the COVID-19 pandemic.

The Annual Meeting will begin with a pre-recorded presentation, followed by a live webcast of the formal business of the Annual Meeting and a Q&A session.

Trustee NomineesAccessing the Meeting

To be admitted to the Annual Meeting, you must enter the control number found on your proxy card or voting instruction form. If your common shares are held through a broker or bank in “street name” as of the close of business on the Record Date, you may vote your shares at the virtual meeting only if you obtain a legal proxy from your brokerage firm, bank or other nominee.

You may vote your shares virtually at the Annual Meeting. To vote at the virtual Annual Meeting, you must re-enter the control number found on your proxy card or voting instruction form. Even if you plan to attend the Annual

Meeting virtually, we recommend that you submit the accompanying proxy card or voting instruction form or vote via the Internet or by telephone by the applicable deadline so that your vote will be counted if you later decide not to attend the virtual Annual Meeting.

As part of the Annual Meeting, we will hold a live, online Q&A session, where shareholders of our Class A or Class B common shares at the close of business on the Record Date will be allowed to ask questions. You may submit questions in real time during the Annual Meeting. We intend to answer all questions submitted before or during the Annual Meeting which are pertinent to the company and the Annual Meeting matters, as time permits. Consistent with our prior virtual and in-person annual meetings, all questions submitted will be generally addressed in the order received, and we limit each shareholder to one question in order to allow us to answer questions from as many shareholders as possible.

If there are matters raised of individual concern to a shareholder, or if a question posed was not otherwise answered, we provide an opportunity for shareholders to contact us separately after the Annual Meeting through the company’s website, www.americanhomes4rent.com under “Investor Relations.”

If you encounter any difficulties accessing or participating in the virtual Annual Meeting, please call the technical support number that will be posted on the Annual Meeting Website log-in page.

8 | American Homes 4 Rent

Our Board consists of eleven members, all of whom are identified below as nominees. Seventhirteen members. Ten of the current trustees are considered “independent” within the meaningand all members of the listing standards of the New York Stock Exchange (the “NYSE”).

Upon the recommendation of our Audit Committee, Nominating and Corporate Governance Committee our Board has nominated the eleven incumbent trustees forre-election to the Board to serve for aone-year term beginning with the Annual Meeting, or until their successors, if any,and Human Capital and Compensation Committee are elected or appointed. Each nominee has consented to be named in this proxy statement and to serve if elected.independent.

The following table presents the name, age and the position(s) held by each person nominated as a trustee

| Nominee | Age | Principal Occupation | Trustee since | Committee Membership | ||||||

Tamara Hughes Gustavson | 58 | Chairman of the Board, American Homes 4 Rent. Real Estate Investor; Philanthropist | 2016 |

| ||||||

David P. Singelyn | 58 | Chief Executive Officer, American Homes 4 Rent | 2012 |

| ||||||

Douglas N. Benham | 63 | President and Chief Executive Officer, DNB Advisors, LLC | 2016 | • Nominating and Corporate Governance (Chair) • Compensation | ||||||

John “Jack” Corrigan | 59 | Chief Investment Officer, American Homes 4 Rent | 2012 |

| ||||||

David Goldberg | 70 | Retired Executive Vice President, American Homes 4 Rent | 2019 |

| ||||||

Matthew J. Hart | 67 | Lead Independent Trustee, American Homes 4 Rent. Retired President and Chief Operating Officer, Hilton Hotels Corporation | 2012 | • Audit • Compensation • Nominating and Corporate Governance | ||||||

James H. Kropp | 71 | Retired Chief Investment Officer, SLKW Investments LLC, and Microproperties LLC | 2012 | • Audit (Chair) | ||||||

Winifred “Wendy” Webb | 62 | Chief Executive Officer, Kestrel Advisors. Former Senior Executive at Ticketmaster and The Walt Disney Company | 2019 | • Compensation • Nominating and Corporate Governance | ||||||

| Nominee | Age | Principal Occupation | Trustee since | Committee Membership | ||||||

Jay Willoughby | 61 | Chief Investment Officer, TIFF Investment Management | 2019 | • Audit • Nominating and Corporate Governance | ||||||

Kenneth M. Woolley | 73 | Founder and Chairman, Extra Space Storage, Inc. | 2012 | • Compensation (Chair) • Audit | ||||||

Matthew R. Zaist | 45 | Former Chief Executive Officer and Director, William Lyon Homes | 2020 |

| ||||||

The Board of Trustees unanimously recommends a vote FOR each of the 11 nominees proposed by the Board.Our Board believes its members collectively have the experience, qualifications, attributes and skills to continue to effectively oversee the management of the company, including a high degree of personal and professional integrity, an ability to exercise sound business judgment on

a broad range of issues, sufficient experience and background to have an appreciation ofappreciate the issues facing the company, a willingness to devote the necessary time to boardBoard duties, a commitment to representing the best interestsinterest of the company and a dedication to enhancing shareholder value. The Board regularly monitors and evaluates its composition to ensure that it continues to support the success of our long-term strategy.

The Board unanimously recommends a vote “FOR” each of the thirteen nominees proposed by the Board.

Nominee | Age | Principal Occupation | Trustee Since | Committee Membership | ||||

Kenneth M. Woolley * | 75 | Chairperson of the Board, American Homes 4 Rent

Founder and Chairperson, Extra Space Storage, Inc. | 2012 |

| ||||

David P. Singelyn | 60 | Chief Executive Officer, American Homes 4 Rent | 2012 |

| ||||

Douglas N. Benham * | 65 | President and Chief Executive Officer, DNB Advisors, LLC | 2016 | • Nominating and Corporate Governance (Chair) • Human Capital and Compensation | ||||

Jack Corrigan | 61 | Chief Investment Officer, American Homes 4 Rent | 2012 |

| ||||

David Goldberg | 72 | Retired Executive Vice President, American Homes 4 Rent | 2019 |

| ||||

Tamara H. Gustavson * | 60 | Real Estate Investor

Philanthropist | 2016 | • Human Capital and Compensation | ||||

Matthew J. Hart * | 70 | Retired President and Chief Operating Officer, Hilton Hotels Corporation | 2012 | • Human Capital and Compensation (Chair) • Nominating and Corporate Governance | ||||

Michelle C. Kerrick * | 59 | Former West Region Market Leader and Managing Partner, Deloitte & Touche LLP | 2020 | • Audit • Human Capital and Compensation | ||||

James H. Kropp * | 73 | Retired Chief Investment Officer, SLKW Investments LLC and Microproperties LLC | 2012 | • Audit (Chair) | ||||

Lynn C. Swann * | 70 | Director for Athene Holding Ltd. and Evoqua Water Technologies | 2020 | • Audit • Nominating and Corporate Governance | ||||

Winifred M. Webb * | 64 | Founder, Kestrel Advisors Former Senior Executive, Ticketmaster, and The Walt Disney Company | 2019 | • Human Capital and Compensation • Nominating and Corporate Governance | ||||

Jay Willoughby * | 63 | Chief Investment Officer, TIFF Investment Management | 2019 | • Audit • Nominating and Corporate Governance | ||||

Matthew R. Zaist * | 47 | Chief Executive Officer, The New Home Company | 2020 | • Audit • Human Capital and Compensation | ||||

* Denotes “independent” member of the Board after the Annual Meeting.

2022 Proxy Statement | 11

Set forth below is biographical information for each of the trustee nominees, including a list of the specific qualifications that were considered for membership on our Board. Each nominee has consented to be named in this proxy statement and to serve if elected.

Kenneth M. Woolley Age: 75 Trustee since: 2012 (Chairperson since 2020) | Chairperson of the Board, American Homes 4 Rent Founder and Chairperson, Extra Space Storage, Inc. | |||

Background • Extra Space Storage, Inc. (NYSE: EXR), Chief Executive Officer • Nevada West Partners (multi-family residential real estate company), Owner • Gaia Real Estate, Partner • LDS Moscow Russia West Mission, President • Brigham Young University, Associate Professor and Adjunct Associate Professor of Business Administration Public Directorships • Extra Space Storage, Inc. (NYSE: EXR), Founder and Chairperson (since 2004) | Education • B.A. in Physics, Brigham Young University • M.B.A. and Ph.D. in Business Administration, Stanford University Qualification Highlights: • Executive Leadership • Real Estate Experience • Treasury/Capital Allocation • Finance/Accounting/Auditing • Corporate Governance • Public Company Board • Public Company Senior Management Experience • Consumer Experience • Risk Assessment & Management • Investor Relations • Capital Markets | |||

Age: 60 Trustee since: 2012 |

| |||

Background • American Homes 4 Rent, Chief Executive Officer (since 2012) • American Homes 4 Rent Advisor, LLC (our former manager), Co-Founder and Chief Executive Officer • Public Storage Canada, Chairperson and President • American Commercial Equities, President • Public Storage (NYSE: PSA), Senior Vice President and Treasurer • Arthur Young & Company • Certified Public Accountant (inactive) Private Directorships • Dean’s Advisory Council to the College of Business at California State Polytechnic University • Philanthropic Foundation at California State Polytechnic University | Education • B.S. in Accounting, California State Polytechnic University • B.S. in Computer Information Systems, California State Polytechnic University Qualification Highlights: • Executive Leadership • Real Estate Experience • Treasury/Capital Allocation • Finance/Accounting/Auditing • Corporate Governance • Human Capital Management • Consumer Experience • Risk Assessment & Management • Investor Relations • Technology • Philanthropic Activities • Capital Markets • Cybersecurity • Government Affairs / Regulatory • ESG | |||

12 | American Homes 4 Rent

Douglas N. Age: Trustee since: 2016 Committees • Nominating and Corporate Governance (Chair) • Human Capital and |

| |||

• DNB Advisors, LLC, President and Chief Executive Officer (since 2006) • Bob Evans Farms, LLC, Executive Chair of the Board • Arby’s Restaurant Group, Inc., President and Chief Executive Officer • RTM Restaurant Group, Inc., Chief Financial Officer Private Directorships • G&N Brands (Santiago, Chile) | Education • B.A. in Accounting, University of West Florida Qualification Highlights: • Executive Leadership • Real Estate Experience • Treasury/Capital Allocation • Finance/Accounting/Auditing • Consumer Experience • Human Capital Management • Corporate Governance • ESG • Risk Assessment & Management • Investor Relations • Public Company Board • Public Company Senior Management Experience • Audit Committee • Capital Markets | |||

Jack Corrigan Age: 61 Trustee since: 2012 |

| |||

| Background • American Homes 4 Rent, Chief Investment Officer (since 2012), Chief Operating Officer (2012-2019) • American Homes 4 Rent Advisor, LLC (our former manager), Chief Operating Officer • A&H Property and Investments, Chief Executive Officer • PS Business Parks Inc. (NYSE: PSB), Chief Financial Officer • LaRue, Corrigan & McCormick, Partner • Storage Equities, Inc., Controller • Arthur Young & Company |  Education • B.S. in Accounting, Loyola Marymount University Qualification Highlights: • Executive Leadership • Real Estate Experience • Treasury/Capital Allocation • Finance/Accounting/Auditing • Risk Assessment & Management • Investor Relations • Public Company Senior Management Experience • Capital Markets | ||

2022 Proxy Statement | 13

David Goldberg Age: 72 Trustee since: 2019 |  Retired Executive Vice President, American Homes 4 Rent | |||

Background • American Homes 4 Rent, Executive Vice President (2012-2019) • American Commercial Equities, Executive Vice President (2011-2019) • Public Storage (NYSE: PSA), Senior Vice President and General Counsel • Law Firm of Sachs & Phelps, Partner • Law Firm of Agnew, Miller & Carlson, Associate and Partner • Law Firm of Hufstedler, Miller, Carlson & Beardsley, Partner Private Directorships • William Lawrence & Blanche Hughes Foundation |  Education • A.B. in History and Social Studies, Boston University • J.D., University of California, Berkeley Qualification Highlights: • Executive Leadership • Real Estate Experience • Corporate Governance • Risk Assessment & Management • Legal Experience • Public Company Senior Management Experience • Government Affairs / Regulatory • Philanthropic Activities | |||

Tamara H. Gustavson Age: 60 Trustee since: 2016 Committees • Human Capital and Compensation | Real Estate Investor Philanthropist | |||

Background • American Commercial Equities, Member (since 2005) • Public Storage (NYSE: PSA), Senior Vice President-Administration Public Directorships • Public Storage (NYSE: PSA) (since 2008) Private Directorships • William Lawrence & Blanche Hughes Foundation • University of Southern California | Education • B.S. in Public Affairs, University of Southern California Qualification Highlights: • Executive Leadership • Real Estate Experience • Human Capital Management • Corporate Governance • Risk Assessment & Management • Public Company Board • Public Company Senior Management Experience • Consumer Experience • Philanthropic Activities | |||

14 | American Homes 4 Rent

Matthew J. Hart Age: 70 Trustee since: 2012 Committees • Human Capital and Compensation (Chair) • Nominating and Corporate Governance | Retired President and Chief Operating Officer, Hilton Hotels Corporation | |||

Background • Hilton Hotels Corporation, President and Chief Operating Officer, Executive Vice President, Chief Financial Officer • Walt Disney Company (NYSE: DIS), Senior Vice President and Treasurer • Host Marriott Corp., Executive Vice President and Chief Financial Officer • Marriott Corporation, Senior Vice President and Treasurer • Bankers Trust Company, Vice President, Corporate Lending Public Directorships • American Airlines (NASDAQ: AAL) (since 2013) • Air Lease Corp. (NYSE: AL) (since 2010) Private Directorships • Heal the Bay | Education • B.A. in Economics and Sociology, Vanderbilt University • M.B.A. in Finance and Marketing, Columbia University Qualification Highlights: • Executive Leadership • Real Estate Experience • Treasury/Capital Allocation • Finance/Accounting/Auditing • Consumer Experience • Human Capital Management • Corporate Governance • Risk Assessment & Management • Investor Relations • Public Company Board • Public Company Senior Management Experience • Audit Committee • Cybersecurity | |||

Michelle C. Age: 59 Trustee since: 2020 Committees • Audit • Human Capital and Compensation | Former West Region Market Leader and Managing Partner, Deloitte & Touche LLP | |||

Background • Deloitte & Touche LLP, West Region Market Leader and Managing Partner (2010-2020), other positions (1985-2010) Public Directorships • The Beauty Health Company (NASDAQ: SKIN) (since 2021) • LDH Growth Corp I (NASDAQ: LDHA) (since 2021) | Education • B.S. in Accountancy, Northern Arizona University Qualification Highlights: • Executive Leadership • Real Estate Experience • Finance/Accounting/Auditing • Human Capital Management • Consumer Experience • Risk Assessment & Management • Technology • Public Company Board • Public Company Senior Management Experience • Audit Committee | |||

2022 Proxy Statement | 15

James H. Kropp Age: 73 Trustee since: 2012 Committees • Audit (Chair) | Retired Chief Investment Officer, SLKW Investments, LLC and Microproperties LLC | |||

Background • SLKW Investments, LLC, Chief Investment Officer (2009-2019) • U.S. Restaurant Properties (Microproperties LLC), Chief Financial Officer • Arthur Young & Company, Licensed as a Certified Public Accountant Public Directorships • FS KKR Capital Corp. (NYSE: FSKR) (since 2015) • KKR RE Select Trust (NASDAQ: KRSTX) (since 2021) • Lead Independent Director PS Business Parks Inc. (NYSE: PSB) (retired in April 2021) Private Directorships • US Restaurant Properties • National Association of Corporate Directors | Education • B.B.A. in Finance, St. Francis College Qualification Highlights: • Executive Leadership • Real Estate Experience • Treasury/Capital Allocation • Debt and Equity Capital Markets • Finance/Accounting/Auditing • Risk Assessment & Management • Investor Relations • Corporate Governance • Public Company Board • Public Company Senior Management Experience • Audit Committee • Capital Markets • Cybersecurity | |||

Lynn C. Swann Age: 70 Trustee since: 2020 Committees • Audit • Nominating and Corporate Governance | Director for Apollo Global Management and Evoqua Water Technologies | |||

Background • Swann, Inc., President (since 1976) Public Directorships • Apollo Global Management, Inc. (NYSE: APO) (since 2022) • Evoqua Water Technologies (NYSE: AQUA) (since 2018) | Education • B.A. in Public Relations, University of Southern California Qualification Highlights: • Executive Leadership • Real Estate Experience • Treasury/Capital Allocation • Human Capital Management • Corporate Governance • ESG • Public Company Board • Public Company Senior Management Experience • Risk Assessment & Management • Finance/Accounting/Auditing • Audit Committee • Government Affairs/Regulatory | |||

16 | American Homes 4 Rent

Winifred M. Age: 64 Trustee since: 2019 Committees • Human Capital and Compensation • Nominating and Corporate Governance | Founder, Kestrel Advisors Former Senior Executive, Ticketmaster, and The Walt Disney Company | |||

Background • Kestrel Advisors, Founder (since 2013) • Tennenbaum Capital Partners, Managing Director • Ticketmaster Entertainment, Corporate Senior Vice President, Chief Communications & Investor Relations Officer • The Walt Disney Company, Corporate Senior Vice President of Investor Relations & Shareholder Services, Executive Director for The Walt Disney Company Foundation Public Directorships • AppFolio (NASDAQ: APPF) (since 2019) • Wynn Resorts (NASDAQ: WYNN) (since 2018) • ABM Industries (NYSE: ABM) (since 2014) Private Directorships • Women Corporate Directors, Los Angeles/Orange County Chapter | Education • B.A., Smith College • M.B.A., Harvard University Qualification Highlights: • Executive Leadership • Real Estate Experience • Finance/Accounting/Auditing • Consumer Experience • Human Capital Management • Corporate Governance • ESG • Risk Assessment & Management • Investor Relations • Technology • Public Company Board • Public Company Senior Management Experience • Audit Committee • Capital Markets • Treasury/Capital Allocation • Cybersecurity | |||

Jay Willoughby Age: 63 Trustee since: 2019 Committees • Audit • Nominating and Corporate Governance |

| |||

Background • TIFF Investment Management, Chief Investment Officer (since 2015) • The Alaska Permanent Fund, Chief Investment Officer • Ironbound Capital Management, Co-Managing Partner • MLIM Equity Funds, Chief Investment Officer, Head of Research • Merrill Lynch Real Estate Fund, Senior Portfolio Manager Private Directorships • TIFF Advisory Services, Inc. • Value Reporting Foundation – | Education • B.A., Pomona College • M.B.A. in Finance, Columbia University Qualification Highlights: • Executive Leadership • Real Estate Experience • Treasury/Capital Allocation • Finance/Accounting/Auditing • Corporate Governance • ESG • Risk Assessment & Management • Investor Relations • Public Company Senior Management Experience • Audit Committee | |||

2022 Proxy Statement | 17

Matthew R. Zaist Age: 47 Trustee since: 2020 Committees • Audit • Human Capital and Compensation | Chief Executive Officer, The New Home Company | |||

Background • The New Home Company, Chief Executive Officer (2021-Present) • William Lyon Homes (formerly NYSE: WLH), President and Chief Executive Officer and member of the Board (2016-2020), President and Chief Operating Officer Public Directorships • William Lyon Homes (formerly NYSE: WLH) (2016-2020) Private Directorships • The New Home Company (formerly NYSE: NWHM) • University of Southern California’s Lusk Center for Real Estate Executive Committee | Education • B.S., Rensselaer Polytechnic Institute Qualification Highlights: • Executive Leadership • Real Estate Experience • Treasury/Capital Allocation • Human Capital Management • Corporate Governance • Risk Assessment & Management • Investor Relations • Capital Markets • Finance/Accounting/Auditing • Public Company Board • Public Company Senior Management Experience • Consumer Experience • Audit Committee | |||

18 | American Homes 4 Rent

How We Are Selected, Elected, Evaluated and Refreshed

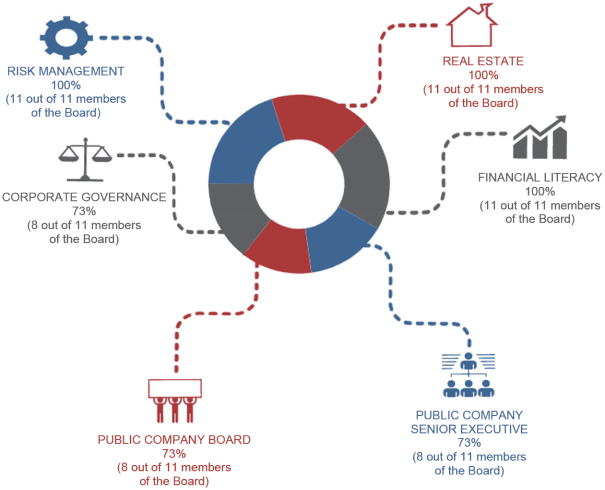

We believe that our trustees should satisfy a number of qualifications, including demonstrated integrity, a record of personal accomplishments, a commitment to participation in Board activities and other attributes. We also endeavor to have a board that represents a range of qualifications, skills and depth of experience in areas that are relevant to and contribute to the Board’s oversight of the company’s business.

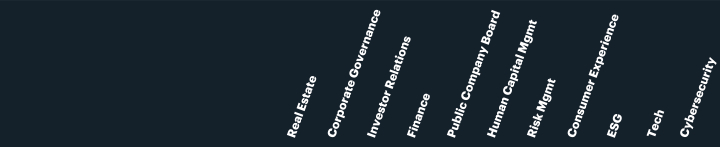

The table below summarizes the key experience, qualifications and attributes for each trustee nominee and highlights the balanced mix of experience, qualifications and attributes of the Board as a whole. This high-level summary is not intended to be an exhaustive list of each trustee nominee’s skills or contributions to the Board. No individual experience, qualification or attribute is solely dispositive of becoming a member of the Board.

| ||||||||||||||||||||||

Kenneth M. Woolley | ● | ● | ● | ● | ● |

| ● | ● |

|

|

| |||||||||||

David P. Singelyn | ● | ● | ● | ● |

| ● | ● | ● | ● | ● | ● | |||||||||||

Douglas N. Benham | ● | ● | ● | ● | ● | ● | ● | ● | ● |

|

| |||||||||||

Jack Corrigan | ● |

| ● | ● |

|

| ● |

|

|

|

| |||||||||||

David Goldberg | ● | ● |

|

|

|

| ● |

|

|

|

| |||||||||||

Tamara Hughes Gustavson | ● | ● |

|

| ● | ● |

| ● |

|

|

| |||||||||||

Matthew J. Hart | ● | ● | ● | ● | ● | ● | ● | ● |

|

| ● | |||||||||||

Michelle C. Kerrick | ● |

|

| ● | ● | ● | ● | ● |

| ● |

| |||||||||||

James H. Kropp | ● | ● | ● | ● | ● |

| ● |

|

|

| ● | |||||||||||

Lynn C. Swann | ● | ● |

| ● | ● | ● |

|

| ● |

|

| |||||||||||

Winifred M. Webb | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||

Jay Willoughby | ● | ● | ● | ● |

|

| ● |

| ● |

|

| |||||||||||

Matthew R. Zaist | ● | ● | ● | ● | ● | ● | ● | ● |

|

|

| |||||||||||

|

| 13 | 11 | 9 | 11 | 9 | 8 | 11 | 8 | 5 | 3 | 4 | |||||||||||

2022 Proxy Statement | 19

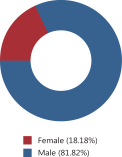

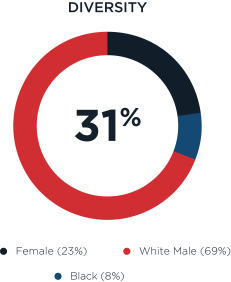

TRUSTEE SKILLSAND QUALIFICATIONSTrustee Ethnic/Racial Diversity. Diversity and inclusion are values embedded in our culture and fundamental to our business. We believe that a board comprised of trustees with diverse backgrounds, experiences, perspectives and viewpoints improves the dialogue and decision-making in the board room and contributes to overall board effectiveness.

The Board strives to achieve a wide range of perspectives by having a Board composed of diverse trustees. We look for each trustee to contribute to the Board’s overall diversity—diversity being broadly construed to mean a variety of identities, perspectives, personal and professional experiences and backgrounds. This can be represented in

both visible and non-visible characteristics that include but are not limited to race, ethnicity, national origin, gender and sexual orientation.

Although the Board does not establish specific goals with respect to diversity, the Board’s overall diversity is a significant consideration in the trustee nomination process. The Board assesses the effectiveness of its approach to Board diversity as part of the Board and committee evaluation process. In order to further advance the Board’s diversity, the Nominating and Corporate Governance Committee requires that any candidate list from a professional search firm include diverse candidates.

|  |

|  |

Trustee Succession PlanningBoard Composition. Our Board consists of thirteen members. Upon the recommendation of our Nominating and Corporate Governance Committee, our Board annually nominates trustees for election or re-election to the Board to serve for a one-year term beginning with the Annual Meeting or until their successors, if any, are elected or appointed.

Each of our thirteen trustees were nominated by the Board upon the recommendation of the Nominating and Corporate Governance Committee, and no trustee was nominated by a shareholder or subject to any agreement with any third party.

Led by our Nominating and Corporate Governance Committee, our Board of Trustees continues to focus on ensuringfacilitating a smooth transition if and when trustees decide to retire or otherwise leave ourthe Board, andas well as ensuring that the composition of our Board is systematically refreshed so that, taken as a whole, the Board hasto maintain the desired mix of skills, experience, independence and diversity to support our strategic direction and operating environment. Since January 2019, we have added four new trustees, three of whom qualify as independent under the rules of the New York Stock Exchange, and all of whom bring extensive operational and executive experience to the Board.

Among other aspects of the succession planning and refreshment process, our Board:

Identifies the collective mix of desired skills, experience, knowledge, diversity and independence of our Board taken as a whole, and identifies potential opportunities for enhancement;

Considers each current trustee’s experience, skills, principal occupation, reputation, independence, age, tenure, committee membership and diversity (including age, tenure, geographic, gender and ethnicity);

Considers the results of the Board and committee self-evaluations;

Has engaged and in the future may engageEngages third-party search firms to assist with identifying and evaluating qualified candidates;candidates, as appropriate; and

Considers the recommendations of Board members and third parties to identify and evaluate potential trustee candidates.

Additional information concerning the trustee nomination and selection process is provided below in “Consideration of Candidates“Identifying and Evaluating Nominees for Trustee.”

We have separate individuals serving as Chairman of the Board and as Chief Executive Officer. Tamara Hughes Gustavson serves as our Chairman. David P. Singelyn serves as Chief Executive Officer and is responsible for theday-to-day management and profitable growth of the company.

Although the positions are currently held by separate individuals, the company does not have a policy against one individual holding the position of Chairman and Chief Executive Officer. Rather, the Board evaluates the desirability of having combined or separate roles for the Chairman and Chief Executive Officer fromtime-to-time and adopts a structure based on what it believes is in the best interests of the company and its shareholders. Currently, the Board believes that having a separate Chairman and Chief Executive Officer serves the interests of the company and its shareholders well.

The Board has also established a position of Lead Independent Trustee to provide for an independent leadership role on the Board at times when the Chairman is not independent. The Lead Independent Trustee, who must be one of the independent trustees, presides at meetings of allnon-management trustees in executive session without the presence of management. These meetings are held on a regular basis, generally before or after each regularly scheduled Board meeting and at the request of anynon-management trustee. In addition, the independent trustees meet separately at least once annually. These sessions are designed to encourage open Board discussion of any matter of interest without our chief executive officer or any other members of management present.

The Lead Independent Trustee also: (1) reviews the agendas for each Board meeting and strategic planning session, (2) in conjunction with the Nominating and Corporate Governance Committee assists in the recruitment and selection of new trustees, (3) evaluates, along with the members of the Compensation Committee, the performance of the Chief Executive Officer, (4) consults with the Chief Executive Officer as to hiring other executive officers, strategic planning and succession planning for the Chief Executive Officer, (5) is regularly apprised of material shareholder inquires and is involved in responding to these inquiries as appropriate, and (6) when necessary or appropriate, communicates with othernon-management and independent trustees and calls meetings of thenon-management and independent trustees.

The Lead Independent Trustee is appointed by the independent trustees annually for aone-year term expiring at the next annual meeting. Matthew J. Hart has been appointed as the Lead independent Trustee and will serve in that role at least until the Annual Meeting.

Biographical Information about our Trustee NomineesIndependence.

Set forth below is biographical information for each of the trustee nominees.

Tamara Hughes Gustavson

Trustee since: August 2016

Ms. Gustavson has served as our Chairman since May 2019 and as a member of the Board since August 2016. She is also a real estate investor and philanthropist and has been a member of the Public Storage (NYSE: PSA) Board of Trustees since November 2008. She was previously employed by Public Storage from 1983 to 2003, serving most recently as Senior Vice President—Administration. During the past five years, Ms. Gustavson has been supervising her personal business investments and engaged in charitable activities. Ms. Gustavson also serves on the Board of Trustees of the William Lawrence and Blanche Hughes Foundation and the Board of Trustees of the University of Southern California. Ms. Gustavson is our largest individual shareholder and a member of the family of B. Wayne Hughes (the Hughes Family) that collectively owns approximately 25% of the company’s outstanding common shares and units of its operating partnership.

Ms. Gustavson is qualified to serve as a trustee of the company due to her extensive real estate, financial and operational experience with private and public companies.

David P. Singelyn

Trustee since: October 2012

Mr. Singelyn has served as our Chief Executive and a trustee since October 2012. Mr. Singelynco-founded AH LLC with B. Wayne Hughes in June 2011 and served as the Chief Executive Officer of our former manager prior to our internalization of senior management in June 2013. From 2003 through April 2013, Mr. Singelyn was Chairman and President of Public Storage Canada, a real estate company previously listed on the Toronto Stock Exchange, where he built a management team that restructured the operations of the company, including building an operations team and installing accounting and operating computer systems. In 2010, Mr. Singelyn facilitated the restructuring of the ownership entity that was traded on the Toronto stock exchange resulting in the company “going private”. In 2005, Mr. Singelyn, along with Mr. Hughes, founded American Commercial Equities (“ACE”), a private real estate company specializing in the acquisition and management of retail property. From 1989 through 2003, Mr. Singelyn served as the Treasurer for Public Storage (NYSE: PSA). Mr. Singelyn is a director of the William Lawrence and Blanche Hughes Foundation, anon-profit organization dedicated to research of pediatric cancer, and is also a member of the Dean’s Advisory Council to the College of Business and a member of the Board of Trustees of the Philanthropic Foundation at California State Polytechnic University. Mr. Singelyn earned a Bachelor of Science in Accounting and a Bachelor of Science in Computer Information Systems from California Polytechnic University—Pomona.

Mr. Singelyn is qualified to serve as a trustee of the company due to his extensive real estate, financial and operational experience with private and public companies.

Douglas N. Benham

Trustee since: March 2016

Mr. Benham has served as a trustee of the company since March 2016 when he was appointed to the Board in connection with the company’s merger with American Residential Properties, Inc., a publicly held owner and operator of single family rental homes. He is Chairman of the Nominating and Corporate Governance Committee and a member of the Compensation Committee. Mr. Benham is the President and Chief Executive Officer of DNB Advisors, LLC, a restaurant industry consulting firm, and served as President and Chief Executive Officer of Arby’s Restaurant Group, Inc. from 2004 to 2006. From 1989 until 2003, he was Chief Financial Officer and, from 1997 until 2003, served on the Board of Directors, of RTM Restaurant Group, Inc., an Arby’s franchisee. Currently, Mr. Benham also serves as a director of CNL Healthcare Properties II, Inc., anon-traded public real estate investment trust. He formerly served as a director of American Residential Properties, Inc. until its acquisition in 2016, as Chairman of the Board and Executive Chair of Bob Evans Farms, Inc. until its acquisition in 2018, as a director of the Global Income Trust, anon-traded public real estate investment trust, until its acquisition in 2015, as a director of Sonic Corp. until 2014, and as a director of O’Charley’s Inc. until its acquisition in 2012. Mr. Benham is also a member of the Board of Advisors/Managers of Border Partners and United Pacific Oil, which are privately held companies. He received a B.A. in Accounting from the University of West Florida.

Mr. Benham is qualified to serve as a trustee of the company because of his experience as a senior executive officer at, and consultant to, various business enterprises, and experience in operating multi-location enterprises, his experience as a board member of other publicly traded companies, including single-family home rental REITs, and his expertise in accounting and finance.

John “Jack” Corrigan

Trustee since: October 2012

Mr. Corrigan has served as a trustee of the company and our Chief Investment Officer since October 2012. Previously, he served as our Chief Operating Officer from 2012 to 2019 and Chief Operating Officer of American Homes 4 Rent Advisor, LLC, our former manager, from 2011 to 2013. From 2006 to 2011, Mr. Corrigan was the Chief Executive Officer of A & H Property and Investments, a full-service leasing and property management company in Los Angeles County with a portfolio of residential, retail, industrial and office properties, where he was responsible for acquisitions, dispositions, development, financing and management operations. From 1998 to 2004, Mr. Corrigan served as Chief Financial Officer of PS Business Parks Inc. (NYSE: PSB), a publicly-traded real estate investment trust specializing in office and industrial properties throughout the United States. Prior to his tenure at PS Business Parks, Mr. Corrigan was a partner in the accounting firm of LaRue, Corrigan & McCormick, where he was responsible for the audit and consulting practice of that firm. Mr. Corrigan began his career at Arthur Young and Company (now a part of Ernst & Young LLP) and served as Vice President and Controller of Storage Equities, Inc. (a predecessor entity to Public Storage). Mr. Corrigan earned a B.S. in Accounting from Loyola Marymount University.

Mr. Corrigan is qualified to serve as a trustee of the company due to his extensive real estate, financial and operational experience with public and private companies.

David Goldberg

Trustee since: May 2019

Mr. Goldberg has served as a trustee of the company since May 2019. Mr. Goldberg served as the company’s Executive Vice President from October 2012 until his retirement in May 2019. Mr. Goldberg held the same position with our former manager from 2011 until the Management Internalization. Since 2006, Mr. Goldberg has been aco-manager of ACE, and since 2006 he has served as a legal consultant and senior counsel for Public Storage. From 1991 until 2005, Mr. Goldberg held various legal positions with Public Storage, including Senior Vice President and General Counsel. In such capacity, Mr. Goldberg was responsible for all Public Storage securities, real estate and property management activities and was involved in capital raising, real estate acquisition, corporate reorganization and property management transactions. From 1974 until 1991, Mr. Goldberg was an associate and a partner in the law firm of Agnew, Miller & Carlson and a partner with the law firm of Sachs & Phelps and with the law firm of Hufstedler, Miller, Carlson & Beardsley. Mr. Goldberg earned an A.B. in History and Social Studies from Boston University and a J.D. from the University of California, Berkeley (Boalt School of Law) and is a member of the California State Bar.

Mr. Goldberg is qualified to serve as a trustee of the company due to his long association with the company in a senior executive capacity and his real estate and legal experience with public and private real estate companies.

Matthew J. Hart

Trustee since: November 2012

Mr. Hart has served as a trustee of the company since November 2012. He is our Lead Independent Trustee and is a member of the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee. Mr. Hart served as President and Chief Operating Officer of Hilton Hotels Corporation, or Hilton, a global hospitality company, from May 2004 until the buyout of Hilton by a private equity firm and his subsequent retirement in October 2007. He also served as Executive Vice President and Chief Financial Officer of Hilton from 1996 to 2004. Prior to joining Hilton, Mr. Hart served as the Senior Vice President and Treasurer of the Walt Disney Company, Executive Vice President and Chief Financial Officer for Host Marriott Corp., Senior Vice President and Treasurer for Marriott Corporation and Vice President, Corporate Lending, for Bankers Trust Company. Mr. Hart currently serves on the Board of Directors of American Airlines Group, Inc. (NASDAQ: AAL) and Air Lease Corporation (NYSE: AL). Mr. Hart was also a director of US Airways Group, Inc. until it merged with American Airlines, Inc. in December 2013 and was a director of B. Riley Financial, Inc. until November 2015. Mr. Hart received a B.A. in Economics and Sociology from Vanderbilt University and an M.B.A. in Finance and Marketing from Columbia University.

Mr. Hart is qualified to serve as a trustee of the company due to his financial expertise, risk management and real estate experience, extensive experience as a senior operating and finance executive in developing strategies for large public companies, his mergers and acquisitions experience, and his service as a public company director.

James H. Kropp

Trustee since: November 2012

Mr. Kropp has served as a trustee of the company since November 2012 and is Chairman of the Audit Committee. From 2009 until his retirement in 2019, Mr. Kropp was employed by SLKW Investments LLC, a family investment office and Microproperties LLC, an investor and asset manager of net leased properties. Since 1998, Mr. Kropp has served as a director of PS Business Parks Inc. (NYSE: PSB) and is member of its Compensation Committee and its Nominating/Corporate Governance Committee. Kropp is also a director of FS KKR Capital Corporation and Chair of its Valuation Committee (since 2018, following the merger of Corporate Capital Trust into FS Investment Company) and FS KKR Capital Corporation II since 2019 following the merger of Corporate Capital Trust 2 with FS Investment Company 2, 3 and 4. Mr. Kropp earned a B.B.A. in Finance from St. Francis College. He was licensed as a CPA while at Arthur Young and Company (now a part of Ernst & Young LLP). He is a Board Leadership Fellow for the National Association of Corporate Directors.

Mr. Kropp is qualified to serve as a trustee of the company due to his knowledge of investment banking and capital markets, specializing in real estate securities, his extensive experience with real estate businesses, including other real estate investment trusts, and his experience as a public company director.

Winifred “Wendy” Webb

Trustee since: January 2019

Ms. Webb has served as a trustee of the company since January 2019 and is a member of the Compensation Committee and the Nominating and Corporate Governance Committee. Ms. Webb is Chief Executive Office of Kestrel Advisors, a position she has held since February 2013. Previously, she was Managing Director of Tennenbaum Capital Partners and TCP Capital Corp. from 2010 to 2013. Ms. Webb was a member of the corporate executive team at Ticketmaster Entertainment as corporate Senior Vice President and Chief Communications & Investor Relations Officer from 2008 to 2010. From 1988 to 2008, she held various positions at The Walt Disney Company, including as corporate Senior Vice President of Investor Relations & Shareholder Services and as Executive Director for The Walt Disney Company Foundation. Her early career was in investment banking. Ms. Webb currently serves on the Boards of Directors of Wynn Resorts (NASDAQ: WYNN), ABM Industries (NYSE: ABM) and AppFolio (NASDAQ: APPF). She previously served on the board of directors of TiVo Inc. (NASDAQ: TIVO) from January 2016 until it was acquired in September 2016, of 9 Spokes International (ASX: 9SP) from 2015 to 2018, of Jack in the Box Inc. (NASDAQ: JACK) from 2008 to 2014, and of nonprofit PetSmart Charities, Inc. from 2014 to 2016. She also serves asCo-Chair of nonprofit Women Corporate Directors (WCD), Los Angeles/Orange County Chapter. Ms. Webb earned a B.A. with honors from Smith College and an M.B.A. from Harvard.

Ms. Webb is qualified to serve as a trustee of the company due to her knowledge of investment banking, extensive experience as a senior finance and investor relations executive, her involvement in real estate-related and digital companies, and her service as a public company director.

Jay Willoughby

Trustee since: January 2019

Mr. Willoughby has served as a trustee of the company since January 2019 and is a member of the Audit Committee and the Nominating and Corporate Governance Committee. Mr. Willoughby is the Chief Investment Officer of TIFF Investment Management where he is responsible for allocating capital on behalf of over 600non-profit institutions for whom TIFF manages capital. Before joining TIFF in 2015, Mr. Willoughby spent four years as the Chief Investment Officer of The Alaska Permanent Fund. Previously, he wasco-managing partner at Ironbound Capital Management and spent nine years with Merrill Lynch Investment Managers, LP as CIO Private Investors Group, head of research for Equity Funds and as Senior Portfolio Manager for the Merrill Lynch Real Estate Fund. He is a CFA charterholder and serves on the board of the Sustainability Accounting Standards Board (SASB) Foundation, which supports the development of accounting standards that help investors understand which sustainability factors can have a material impact on the future financial performance of individual public companies. Mr. Willoughby received a B.A. from Pomona College and an M.B.A. in Finance from Columbia University.

Mr. Willoughby is qualified to serve as a trustee of the company due to his knowledge of investment management, his experience as a real estate investor and knowledge of the single family rental business in general and the company in particular resulting from his role as the Chief Investment Officer of The Alaska Permanent Fund when it made an early investment in the company and his membership on the board of the SASB Foundation.

Kenneth M. Woolley

Trustee since: November 2012

Mr. Woolley is Chairman of the Compensation Committee and a member of the Audit Committee and has served as a trustee since November 2012. He is the founder of Extra Space Storage, Inc. (NYSE: EXR), or Extra Space, a self-storage real estate investment trust, and he currently serves as its Chairman. He served as Chairman and Chief Executive Officer of Extra Space from its inception in 2004 until his retirement as Chief Executive Officer in March 2009 and was formerly Chief Executive Officer of Extra Space’s predecessor. From 1994 to 2002, he was an active participant on Storage USA’s Advisory Board. From 1983 to 1989, he acted as a preferred developer for Public Storage, Inc. Mr. Woolley has also developed over 13,000 apartment units in 40 projects and acquired over 15,000 apartment units in the past 25 years and is the founder of several companies in the retail, electronics, food manufacturing, airline and natural resources industries. Mr. Woolley received a B.A. in Physics from Brigham Young University and an M.B.A. and Ph.D. in Business Administration from Stanford University, Graduate School of Business.

Mr. Woolley is qualified to serve as a trustee of the company due to his extensive experience with public real estate companies, including his executive experience with Extra Space, experience with multi-family rental properties and service as a public company director.

Matthew R. Zaist

Trustee since: February 2020

Matthew R. Zaist has served as a trustee of the company since February 2020. Mr. Zaist was President and Chief Executive Officer and a member of the Board of William Lyon Homes from 2016 until the company was acquired in 2020 by Taylor Morrison Home Corporation. Mr. Zaist joined William Lyon Homes in 2000 and from 2013 to 2015 served as its President and Chief Operating Officer and served as President andCo-Chief Executive Officer from 2015 to 2016. William Lyon Homes (formerly NYSE: WLH) and its subsidiaries designed, constructed, marketed and sold single-family homes in California, Arizona, Nevada, Colorado, Washington, Oregon and Texas. Mr. Zaist holds a B.S. from Rensselaer Polytechnic Institute and is a member of the Executive Committee for the University of Southern California’s Lusk Center for Real Estate.

Mr. Zaist is qualified to serve as a trustee of the company due to his extensive experience with one of the nation’s largest homebuilders in the Western United States, which is a growing part of the company’s business. He also brings his experience as a public company director.

Our Board unanimously recommends that you vote “FOR” all eleven nominees for trustee for aone-year term.

Corporate Governance Framework

We describe our corporate governance highlights on page 5. We have structured our corporate governance in a manner we believe closely aligns our interests with those of our shareholders. Notable features of our corporate governance include:

Annual Election of all Trustees

Majority Voting for Trustees in Uncontested Elections

Lead Independent Trustee

Regular Executive Sessions ofNon-Management Trustees

Separation of CEO and Chairman

Trustee Retirement Policy

Anti-Hedging and Anti-Short Sale Policies

Compensation Clawback Policy

Double Trigger Vesting for Time Based Equity Awards

The framework of our corporate governance is set forth in our charter and bylaws and the following documents:

Corporate Governance Guidelines that outline the Board’s overall governance practices

Charters of the Audit, Compensation and Nominating and Corporate Governance Committees

The Code of Business Conduct and Ethics applicable to trustees, officers and all employees

Code of Ethics for Senior Financial Officers

The Corporate Governance Guidelines and the Code of Business Conduct and Ethics are reviewed at least annually by the Nominating and Corporate Governance Committee, which considers whether to recommend any changes to the Board. Each Board committee reviews its charter at least annually.

The company’s Code of Business Conduct and Ethics, the Corporate Governance Guidelines and the Board committee charters are available on the company’s website, www.americanhomes4rent.com under the tab “For Investors.” A copy of each may be obtained by sending a written request to the company’s Investor Relations Department, American Homes 4 Rent, 30601 Agoura Road, Suite 200, Agoura Hills, California 91301, or submitting an information request under the tab “For Investors” on the company’s website. Any amendments or waivers to the Code of Business Conduct and Ethics for trustees or executive officers may be made only by the Nominating and Corporate Governance Committee of our Board and will be disclosed on the company’s website or other appropriate means in accordance with applicable SEC and NYSE requirements.

Extensive Shareholder Engagement

We value and actively solicit feedback from our shareholders. During fiscal year 2019, management met with over 300 institutional investors at conferences and investor meetings, and at our Security Analyst Meeting.

Board Responsibilities and Oversight of Risk Management

The Board is responsible for overseeing the company’s approach to major risks and our policies for assessing and managing these risks. As part of its oversight function, the Board regularly receives presentations from management on areas of risk facing our business. The Board and management actively engage in discussions about these potential and perceived risks to the business.